How to Remove a Charge Off From Your Credit Report

Credit Repair

Introduction

Welcome to Life Designers, a leading consulting and coaching company in the business and consumer services industry. In this comprehensive guide, we will walk you through the process of removing a charge off from your credit report.

Understanding Charge Offs

A charge off occurs when a creditor writes off a debt as uncollectible. This is usually done after a certain period of non-payment, typically six months. While a charge off reflects negatively on your credit report and lowers your credit score, it doesn't mean you're no longer responsible for the debt.

Steps to Remove a Charge Off

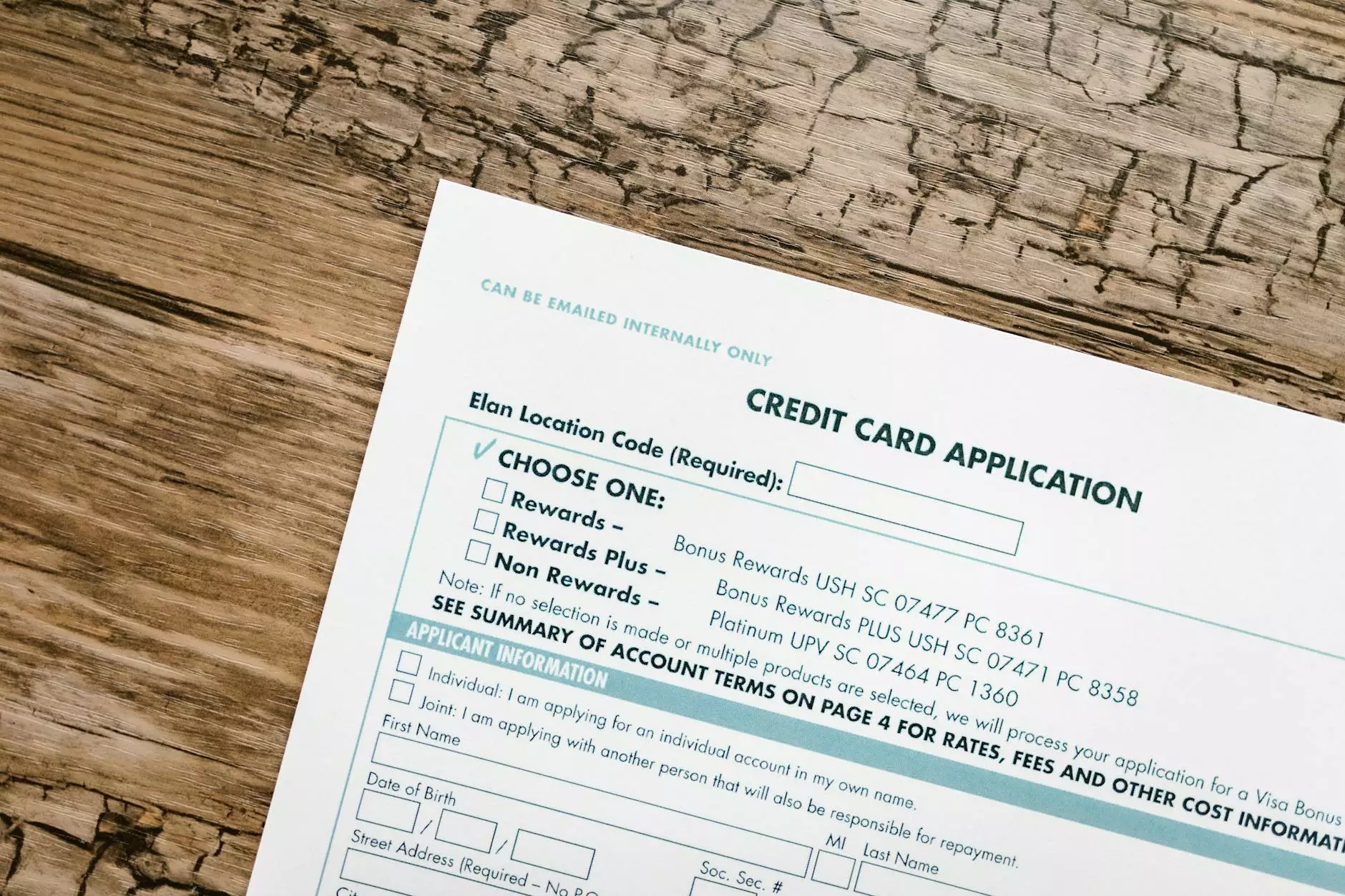

Step 1: Review your Credit Report

Start by obtaining a copy of your credit report from the major credit bureaus – Experian, Equifax, and TransUnion. Carefully review the report to identify the charge off entry.

Step 2: Validate the Debt

Before proceeding, it's important to validate the debt. Send a written request to the creditor, asking for proof that the debt is indeed yours. This can help you identify any errors or discrepancies.

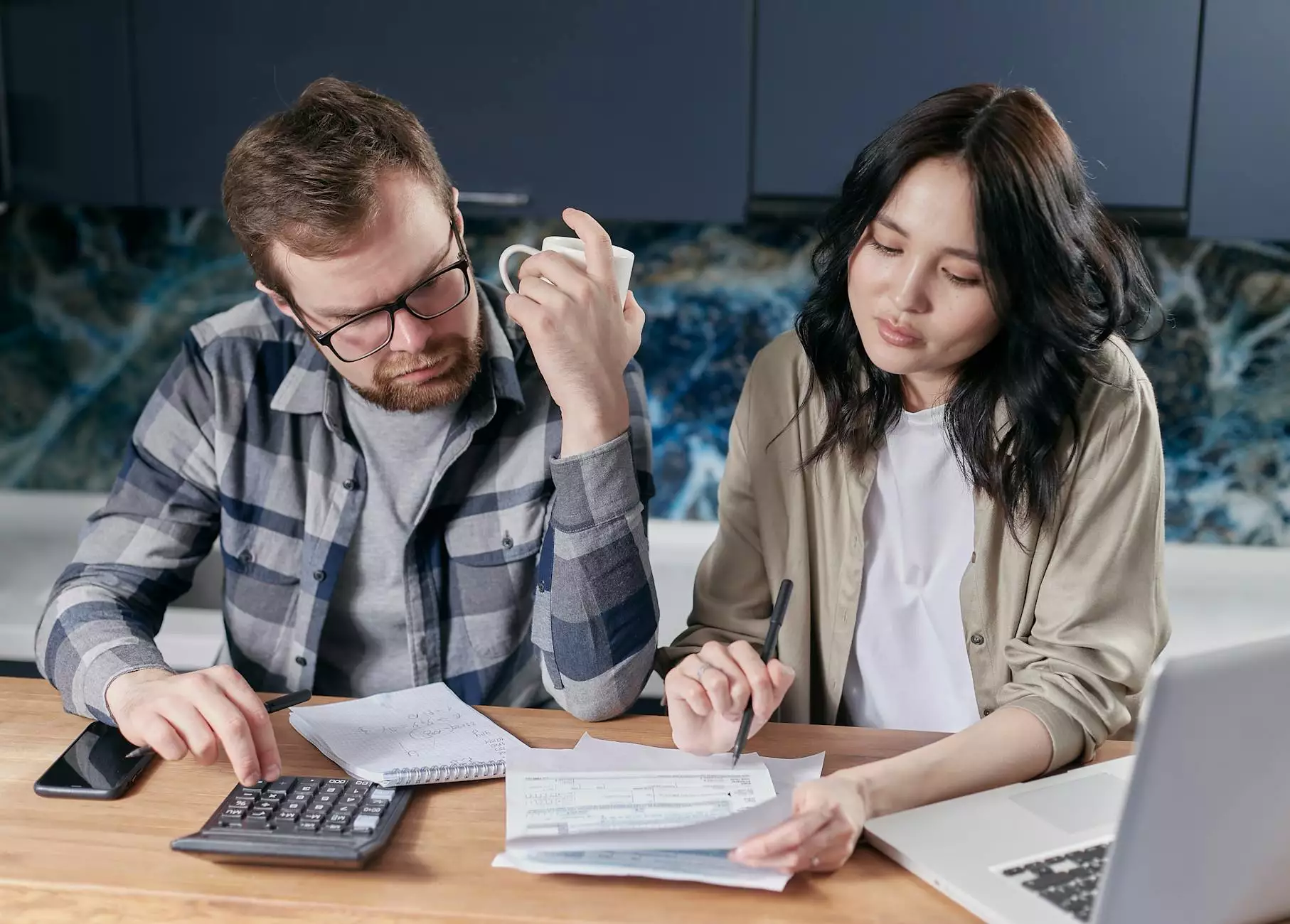

Step 3: Negotiate a Payment Plan

If the debt is indeed accurate, consider contacting the creditor to negotiate a payment plan. Explain your situation and propose a reasonable monthly payment that you can afford. Many creditors are open to such arrangements, as they want to recover at least a portion of the debt.

Step 4: Request a Goodwill Adjustment

If you have successfully paid off the charged off debt, you can send a goodwill letter to the creditor. In this letter, explain the circumstances that led to the charge off, express your intention to maintain good credit, and kindly request the creditor to remove the charge off from your credit report as a gesture of goodwill.

Step 5: Dispute Inaccurate Information

If you believe the charge off is inaccurate or there are errors in the reporting, you can file a dispute with the credit bureaus. Provide supporting documentation and explain why the information is incorrect. The credit bureaus will investigate and remove any discrepancies if they find them to be valid.

Step 6: Seek Professional Assistance

If you find the process overwhelming or encounter difficulties, seeking professional assistance from credit repair experts like Life Designers can be beneficial. With our experience and knowledge, we can guide you through the steps, handle negotiations, and ensure your credit report is accurate and reflects your current financial situation.

Conclusion

Removing a charge off from your credit report can be challenging, but not impossible. By following the steps outlined above, you can take control of your credit and improve your financial standing. Remember to stay persistent and proactive in your efforts, as positive changes to your credit score take time. For expert guidance and personalized assistance, contact Life Designers, the trusted name in consulting and coaching for individuals looking to overcome credit obstacles and achieve financial success.