How to Start Managing Business Finances

Personal Finance

Introduction

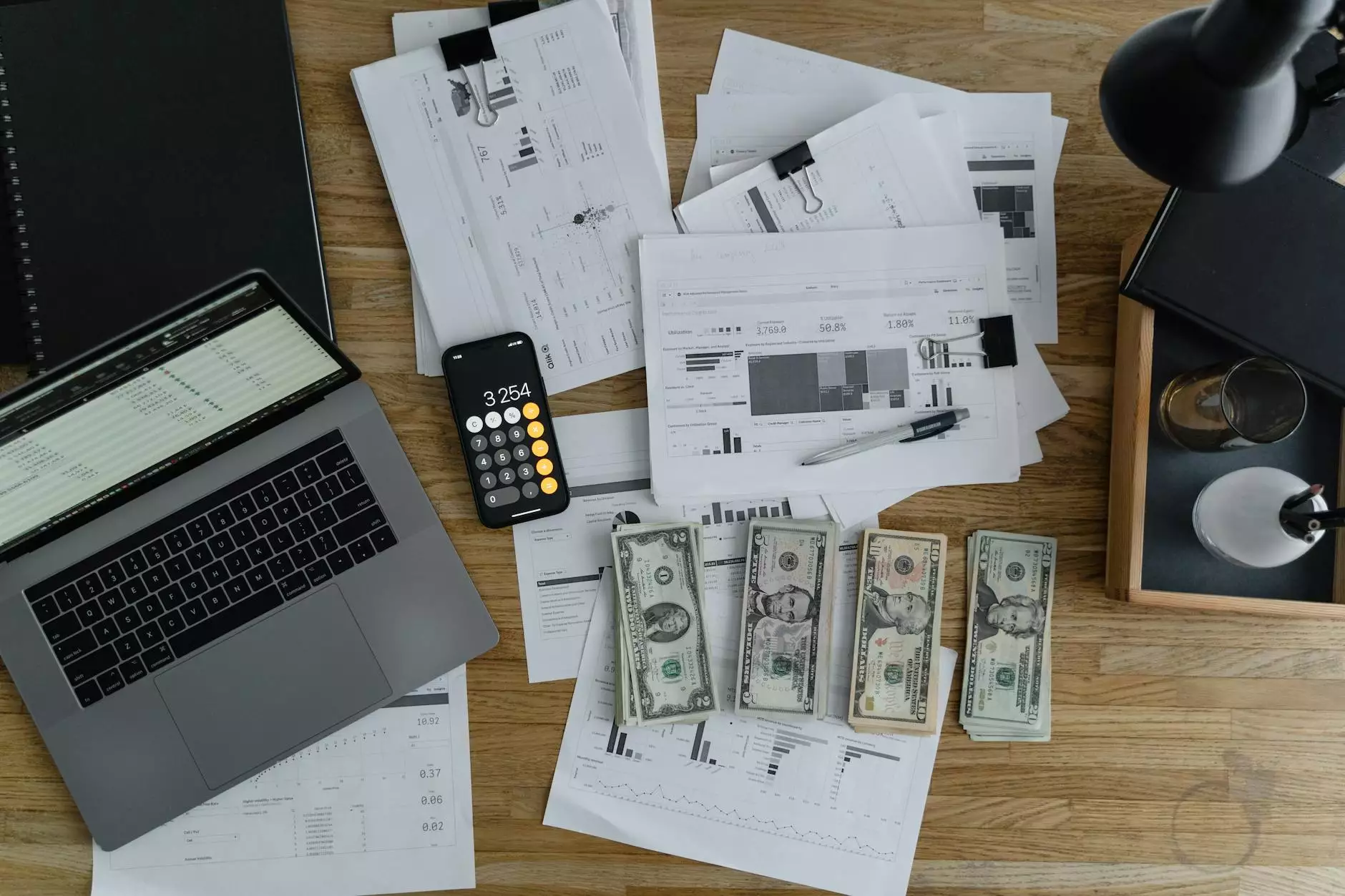

Welcome to Life Designers, your trusted partner in the journey of managing business finances. In this comprehensive guide, we will provide you with expert insights, strategies, and tips to help you effectively handle your company's financial affairs. Whether you are a new entrepreneur or an established business owner, understanding and managing finances is crucial for sustainable growth and long-term success.

The Importance of Managing Business Finances

Proper financial management is the backbone of any successful business. It not only ensures that you have control over your resources, but also enables you to make informed decisions, allocate funds wisely, and plan for the future. By effectively managing your business finances, you can optimize cash flow, minimize risks, and maximize profitability.

Setting Up a Financial Management System

The first step in managing your business finances is to establish a robust financial management system. This involves organizing your financial records, setting up accounting software, and creating a budget. With the help of Life Designers' expert consulting services, you can streamline your financial processes and gain a clear understanding of your company's financial health.

1. Organizing Financial Records

It is essential to maintain accurate and up-to-date financial records. This includes invoices, receipts, bank statements, and tax documents. By keeping your records organized, you can easily track income and expenses, identify trends, and ensure compliance with legal and regulatory requirements.

2. Implementing Accounting Software

Leveraging modern accounting software can significantly simplify financial management tasks. From generating financial statements to reconciling transactions, these software solutions provide real-time visibility into your business's financial performance. Our skilled consultants at Life Designers can help you choose and integrate the right accounting software tailored to your specific needs.

3. Creating a Budget

A well-defined budget is a powerful tool for effective financial management. It allows you to allocate resources efficiently, plan for future investments, and measure performance against financial goals. Our consulting and analytical services can assist you in developing a comprehensive budget that aligns with your business objectives and growth plans.

Financial Analysis and Reporting

To gain meaningful insights into your company's financial performance, you need to analyze and report key financial metrics on a regular basis. This will help you identify areas of improvement, make data-driven decisions, and respond promptly to any financial challenges. At Life Designers, we specialize in providing actionable reports and analysis that paint a clear picture of your financial standing.

1. Financial Ratios and Metrics

Understanding financial ratios and metrics is crucial for assessing the health and performance of your business. Our consulting experts can guide you through important ratios such as profitability, liquidity, and solvency, enabling you to make strategic decisions based on a solid financial foundation.

2. Cash Flow Management

Effective cash flow management ensures that you have enough liquidity to cover expenses and pursue growth opportunities. We offer comprehensive cash flow analysis and forecasting services to help you maintain a healthy cash flow, manage working capital, and optimize your financial resources.

3. Financial Planning and Forecasting

Developing a financial plan and projecting future financial performance is essential for business growth and sustainability. Our consultants can assist you in creating detailed financial forecasts, helping you identify potential challenges and opportunities in a volatile market.

Tax Planning and Compliance

Proper tax planning and compliance are essential to avoid legal issues and optimize tax obligations. Our experts at Life Designers can help you navigate through complex tax regulations, minimize tax liabilities, and ensure compliance with local and international tax laws.

1. Tax Structure and Strategy

We provide strategic advice on tax structuring that aligns with your business goals and minimizes tax liability. Our consultants analyze your unique circumstances and devise tax-efficient strategies that optimize your financial position.

2. Tax Compliance

Staying compliant with tax laws can be a daunting task. Our experienced team can support you in fulfilling your tax obligations, preparing accurate tax returns, and keeping you updated on regulatory changes that may impact your business.

3. Tax Optimization

Optimizing your tax position is crucial for preserving profitability and freeing up resources for growth. Our tax optimization services not only help you identify legitimate deductions and credits but also provide proactive recommendations for long-term tax planning and savings.

Risk Management and Insurance

Protecting your business from potential risks and liabilities is paramount. At Life Designers, we offer risk management and insurance consulting services to safeguard your company's financial interests.

1. Risk Assessment

Our consultants conduct comprehensive risk assessments to identify potential threats and vulnerabilities in your business. By understanding your risk profile, we can help you implement effective risk management strategies and reduce financial exposure.

2. Insurance Planning

Choosing the right insurance coverage is crucial for mitigating financial losses and protecting your business assets. Our experts analyze your specific needs and provide tailored insurance solutions that offer comprehensive coverage and peace of mind.

3. Business Continuity Planning

Disruptions and unforeseen events can cripple a business if not adequately prepared for. Our consultants assist you in developing robust business continuity plans that minimize financial impact and enable swift recovery in times of crisis.

Conclusion

Managing your business finances effectively requires a combination of expertise, strategy, and continuous monitoring. At Life Designers, we understand the complexities of financial management and offer comprehensive consulting and coaching services tailored to your unique needs. By partnering with us, you can gain the necessary knowledge and tools to navigate the complex world of business finance, optimize profitability, and achieve sustainable growth.