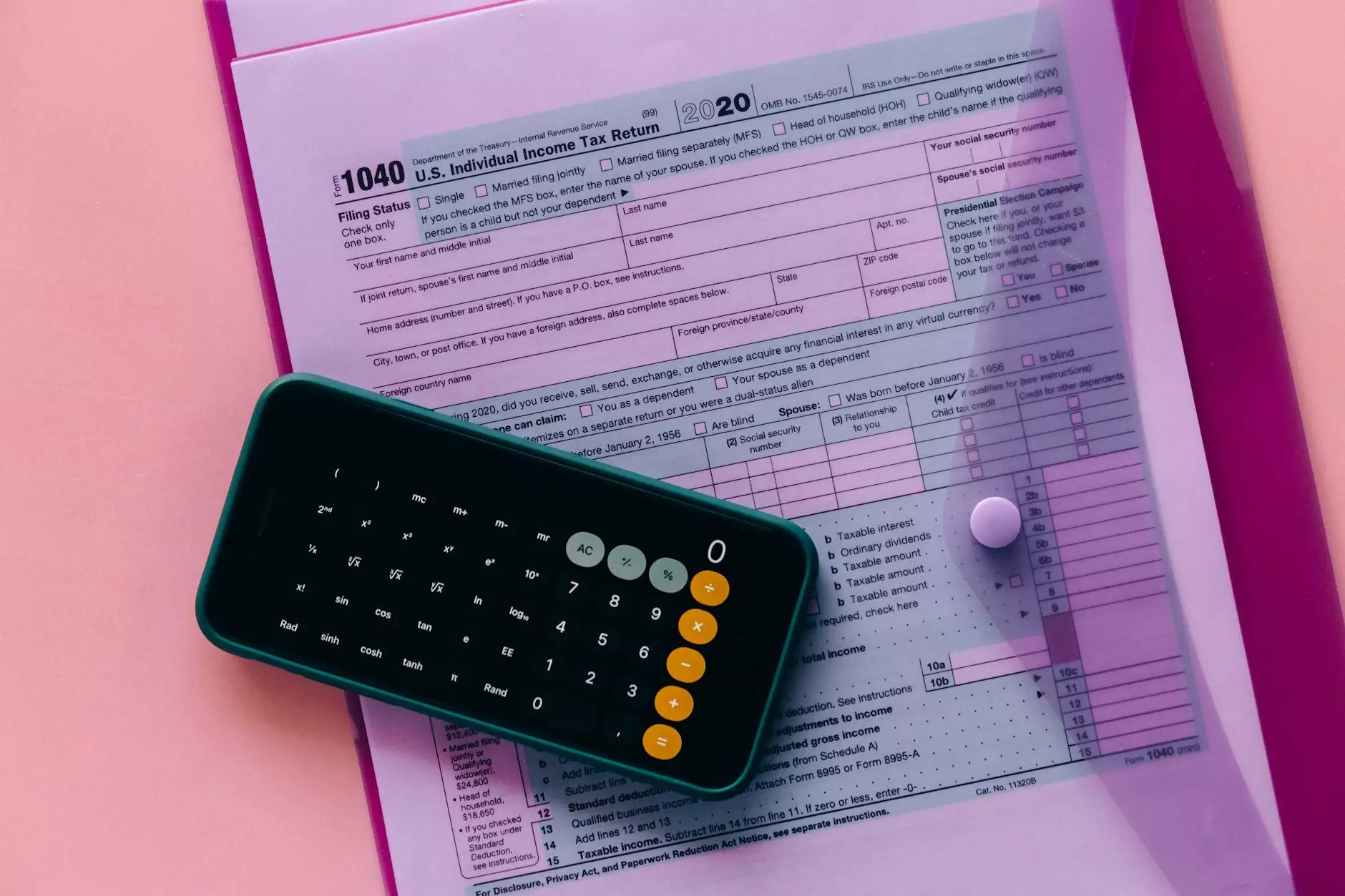

Tax Extenders in 2020 Federal Spending Bill

Tax and Accounting

Introduction

Welcome to Life Designers' comprehensive guide to the key tax extenders and provisions from the 2020 Federal spending bill. As a leading consulting and analytical services firm in the business and consumer services industry, we understand the importance of staying up-to-date with the latest changes in tax regulations. This guide aims to provide you with detailed insights and strategies to optimize your tax planning in light of these new provisions.

Understanding Tax Extenders

Tax extenders refer to temporary tax breaks that are periodically extended by Congress. These provisions are designed to incentivize certain behaviors, stimulate economic growth, and support specific industries. In the 2020 Federal spending bill, several key tax extenders were introduced or extended to provide relief and support for businesses and individuals alike.

Key Provisions

1. Research and Development (R&D) Tax Credit: The Federal spending bill extended the R&D tax credit, providing businesses with an opportunity to offset their research and development costs. This credit encourages innovation and promotes the advancement of technology across various industries.

2. Renewable Energy Tax Incentives: The bill also introduced or extended tax incentives for renewable energy projects, such as solar and wind power. These incentives aim to accelerate the adoption of clean energy sources, reduce greenhouse gas emissions, and promote sustainability.

3. Work Opportunity Tax Credit (WOTC): The WOTC provides a tax credit to businesses that hire individuals from certain targeted groups, such as veterans or long-term unemployed individuals. The 2020 Federal spending bill extended and expanded this credit to encourage workforce diversity and inclusivity.

4. Section 179 Expensing: The bill increased the maximum amount a business can expense under Section 179, allowing for accelerated deductions on qualifying asset purchases. This provision enables businesses to invest in equipment and technology while reducing their taxable income.

5. Residential Energy Efficient Property Credit: Homeowners who invest in energy-efficient improvements, such as solar panels or geothermal heat pumps, can take advantage of this tax credit. The 2020 Federal spending bill extended this credit, encouraging individuals to make environmentally friendly upgrades to their homes.

How Life Designers Can Help

At Life Designers, we specialize in providing consulting and analytical services to help businesses and individuals navigate complex tax regulations and optimize their tax strategies. With our team of experienced professionals, we can assist you in taking full advantage of the tax extenders and provisions outlined in the 2020 Federal spending bill.

Our Services

1. Tax Planning and Strategy: Our experts will analyze your financial situation and develop a customized tax plan to maximize your savings. We stay updated on the latest tax laws and leverage our expertise to minimize your tax liability.

2. Research and Development (R&D) Tax Credit Consulting: We specialize in helping businesses claim and optimize the R&D tax credit. Our team will work closely with you to identify qualifying activities and expenses, ensuring you receive the maximum benefit.

3. Renewable Energy Tax Incentives Guidance: If you're considering investing in renewable energy projects, our consultants can guide you through the complex tax incentives available. We will assist you in navigating eligibility criteria, documentation requirements, and claim procedures.

4. Work Opportunity Tax Credit (WOTC) Compliance: Our professionals will help you determine eligibility for the WOTC and ensure proper documentation and compliance. We can guide you through the process of hiring qualified individuals and claiming the tax credit.

5. Section 179 Expensing Optimization: Our team will analyze your asset purchases and develop a strategy to maximize your Section 179 expensing benefits. We will help you identify qualifying assets, calculate deductions, and implement an effective expensing plan.

6. Residential Energy Efficient Property Credit Advisory: If you're planning energy-efficient improvements for your home, we can assist you in understanding the eligibility criteria for the residential energy efficient property credit. Our consultants will guide you through the process, ensuring proper documentation and compliance.

Contact Life Designers Today

Don't let the complexities of the 2020 Federal spending bill's tax extenders overwhelm you. Life Designers is here to support you in optimizing your tax strategy and taking advantage of the available opportunities. Contact us today to schedule a consultation and discover how our consulting and analytical services can benefit your business or personal finances.

Life Designers: Empowering Your Financial Success