Gross Income vs. Net Income

Blog

The Importance of Understanding Gross and Net Income

When it comes to personal finances, understanding the difference between gross income and net income is essential. Gross income refers to the total amount of money earned before deductions and taxes, while net income represents the actual amount of income received after deductions. In this article, we will delve into the definitions of both terms, their significance, and how Life Designers' consulting and coaching services can guide you in optimizing your financial strategies.

Gross Income Explained

Gross income is the total income earned by an individual or business from various sources, such as salary, wages, business revenue, investments, and rental income, before any deductions. It is important to note that gross income does not take into account expenses, taxes, or other deductions.

For individuals, gross income typically refers to the amount earned before taxes and deductions are subtracted from their paychecks. It is the amount mentioned in annual salary negotiations or employment contracts. Gross income serves as the starting point for calculating total taxable income.

For businesses, gross income refers to the revenue generated from sales or services before deducting business expenses, such as rent, salaries, utilities, and taxes. It provides insight into the initial profitability of the company before factoring in operating costs.

Net Income Explained

Net income, also known as take-home pay or net pay, represents the actual amount of income an individual or business receives after deducting taxes and other expenses from the gross income. Net income is the amount available for saving, investing, and covering personal expenses.

For individuals, net income is the amount deposited into their bank accounts after payroll deductions, such as income tax, Social Security, Medicare, and health insurance premiums. It is the actual income that individuals utilize for budgeting and managing their personal finances.

For businesses, net income refers to the final profitability after deducting all expenses, including cost of goods sold, overhead expenses, taxes, and other operational costs. It provides an accurate representation of the company's financial health and profitability.

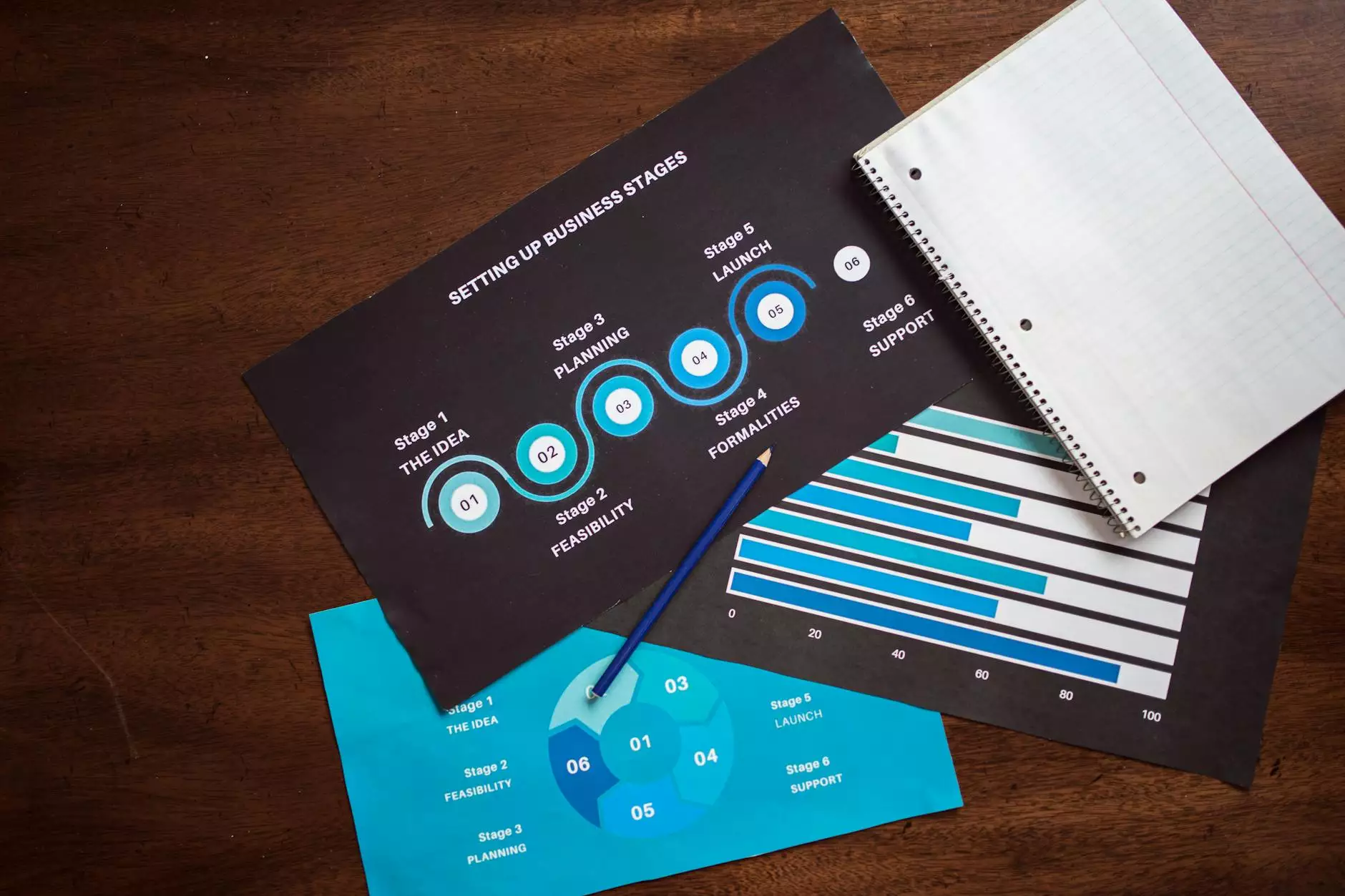

Optimizing Your Financial Strategies with Life Designers

At Life Designers, we understand that managing and optimizing your financial strategies can be overwhelming. Our team of experienced consulting and coaching professionals specializes in providing personalized guidance to help you make informed financial decisions.

With our expertise in the field of business and consumer services - consulting & analytical services, we can assist you in understanding the nuances of gross and net income, helping you maximize your financial potential. Our experts will work closely with you to create comprehensive financial plans tailored to your unique circumstances and goals.

The Benefits of Life Designers' Services

1. Personalized Financial Guidance

Our consultants and coaches take the time to understand your specific financial situation, goals, and aspirations. By providing personalized guidance, we empower you to make effective financial decisions that align with your long-term objectives.

2. Holistic Financial Planning

We believe in a holistic approach to financial planning. Our comprehensive strategies encompass not just gross and net income management, but also budgeting, investment planning, risk management, and retirement planning. We ensure all aspects of your financial well-being are considered.

3. Tailored Solutions

Every individual and business is unique, and we recognize that. Our consultants and coaches provide tailored solutions to address your specific financial challenges. We believe that one size does not fit all, and our customized approach sets us apart.

4. Ongoing Support and Education

Our commitment to your financial success extends beyond consultations. We offer ongoing support and education to help you stay informed about the latest financial trends and strategies. We empower you with the knowledge to make informed decisions throughout your financial journey.

Conclusion

Understanding the difference between gross income and net income is crucial for effective financial management. Life Designers, a leading firm specializing in consulting and coaching services, is here to guide you in optimizing your financial strategies. Whether you are an individual seeking personal financial planning or a business owner aiming to enhance profitability, our expert team will provide personalized solutions to help you achieve your financial goals.