How Will Ownership Transfer Affect My Credit?

Blog

Welcome to the Life Designers blog! In this article, we will explore how ownership transfer can impact your credit score and overall financial well-being. Whether you are buying a new house or car, selling a property, or transferring ownership in any other business or consumer transaction, it's crucial to understand the potential consequences on your creditworthiness.

Understanding Ownership Transfer

Ownership transfer refers to the legal process of changing the title, rights, and responsibilities of a property or asset from one party to another. It is a common occurrence in various aspects of life, such as real estate transactions, business acquisitions, and personal property exchanges. While ownership transfer itself doesn't directly affect your credit, certain activities associated with the process can impact your creditworthiness.

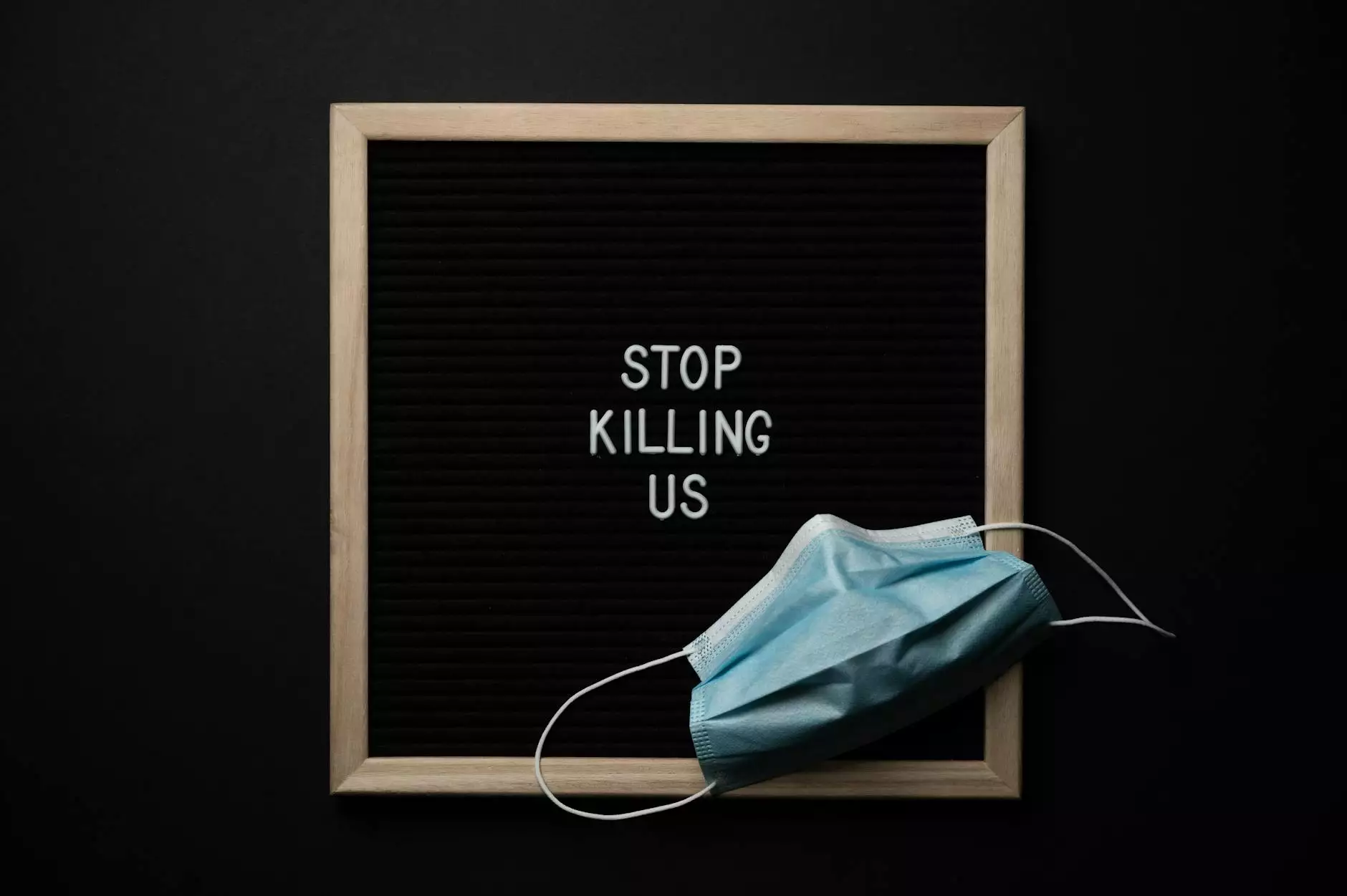

The Impact on Credit Scores

One of the main concerns related to ownership transfer is its potential impact on credit scores. Your credit score is a numerical representation of your creditworthiness, and lenders and financial institutions use this score to assess your ability to manage debt and repay loans. Here are a few scenarios that may affect your credit score during ownership transfer:

- Applying for New Credit: When you apply for a new loan or credit card as part of the ownership transfer process, the lender will likely perform a hard inquiry on your credit. Multiple hard inquiries within a short period can temporarily lower your credit score.

- Transferring Debt: If you are transferring a loan or debt along with the ownership transfer, it's essential to ensure that the new responsible party makes timely payments. Late or missed payments can impact both parties' credit scores.

- Closing Accounts: In some cases, you may need to close existing accounts as a part of the ownership transfer. Closing accounts can affect your credit utilization ratio, which is the amount of available credit you're using. A higher utilization ratio can lower your credit score.

Protecting Your Credit During Ownership Transfer

While ownership transfer can create potential credit risks, there are steps you can take to protect your credit during the process:

- Plan Ahead: Proper planning before the ownership transfer can help minimize any negative impact on your credit. Create a financial strategy and consult with experts, such as the consultants and coaches at Life Designers, for guidance.

- Monitor Your Credit: Regularly monitoring your credit and staying updated on any changes or discrepancies can help you address issues promptly. Many credit reporting agencies offer free credit monitoring services.

- Communicate with Creditors: If you anticipate any challenges or difficulties in making timely payments during the ownership transfer, it's crucial to communicate with your creditors. Explaining the situation and potentially arranging alternative payment arrangements can help protect your credit.

- Seek Professional Assistance: A reputable consulting and coaching service like Life Designers can provide valuable insights and strategies to navigate the ownership transfer process and protect your credit. Their expertise in financial planning and credit management can be a great asset.

Conclusion

Ownership transfer can indeed impact your credit score and financial well-being. However, by understanding the potential implications and taking proactive measures, you can safeguard your credit and ensure a smooth transition. Life Designers, a leading consultancy and coaching firm specializing in business and consumer services, offers expert guidance and support throughout the ownership transfer process. Contact their team of professionals today to empower yourself with the knowledge and strategies needed for a successful transfer.